Mortgage Broker Sunbury | Borrowing Capacity Strategists | Get the Best Deal in Under 20 Seconds

Property Finance

Purchase a home to live in

We initiate our process by comprehensively assessing your needs and borrowing capacity. From there, we take charge of submitting and securing loan approval while providing valuable purchasing advice and free property reports. Our process never ends, every six months post-settlement, we proactively liaise with your bank to secure the most competitive interest rates, ensuring you’re always benefiting from the lowest possible rates.

Property Investment

When it comes to investment properties, the landscape is multifaceted. We specialise in leveraging equity efficiently, transforming non-deductible debt into deductible debt, optimising cash flow, structuring ownership effectively, and navigating lender-specific investment policies. With a track record of crafting countless property portfolio plans, we’ve paved the way for secure retirements. As seasoned property investors ourselves, we possess a deep understanding of the nuanced advantages and complexities inherent in the broader investment landscape.

Refinancing

Unlock the potential of refinancing your home for tailored financial benefits. Secure lower interest rates to cut monthly mortgage payments and save substantially over time. Our track record speaks volumes – in the past 12 months alone, we’ve saved customers an average of $47,306 over the loan term. Plus, tap into your home equity through cash-out refinancing for home renovations, debt consolidation, or investment endeavours. Discover refinancing options to enhance your financial strategy and realise your homeownership aspirations.

Construction

Crafting your dream home requires a tailored construction loan, providing flexibility and financial oversight throughout the process. Unlike typical mortgages, construction loans disburse funds incrementally, addressing land acquisition and construction costs separately. In Sunbury, where construction loans are common, we facilitate a seamless process. Purchase land without a building contract effortlessly is also common. Allow us to steer your construction loan journey, ensuring a smooth path to your dream home.

Commercial

Trust in our expertise for your commercial property loan needs. With a deep understanding of Australia’s lending landscape and extensive experience in securing commercial financing, we provide tailored solutions to suit your business goals. From small enterprises to large corporations, we navigate the complexities of commercial lending, ensuring competitive rates and favourable terms. Partner with us to streamline the loan process and unlock opportunities for your commercial ventures.

SMSF

Secure your retirement with expert guidance in SMSF property loans. With specialised knowledge of SMSF lending regulations and extensive experience in property investments within SMSFs, we tailor solutions to your retirement goals. From residential to commercial property, we navigate SMSF lending intricacies for favourable terms and optimal investment potential. Let me lead you through a seamless journey toward building your retirement wealth, ensuring your future is in capable hands

Bridging Loan

Unlock seamless property transitions with our bridging loan solutions in Australia. Whether you’re upgrading, downsizing, or relocating, we bridge the gap between buying your new property and selling your current one. Our short-term financing options provide flexibility and convenience, ensuring you secure your dream property without delays. With specialised knowledge and personalised guidance, we navigate the complexities of bridging finance, delivering tailored solutions to suit your needs. Trust us to streamline your property journey and facilitate a smooth transition to your next chapter.

Reverse Mortgage

Experience financial freedom in retirement with our tailored reverse mortgage solutions. Unlock the equity in your home without the burden of monthly repayments. Whether you’re supplementing retirement income, funding healthcare expenses, or renovating your home, our specialised reverse mortgage options provide flexibility and peace of mind. With expert guidance and personalised support, we navigate the intricacies of reverse mortgages, ensuring you maximise your home’s value while maintaining ownership. Embrace retirement with confidence and security, knowing you have a trusted partner by your side.

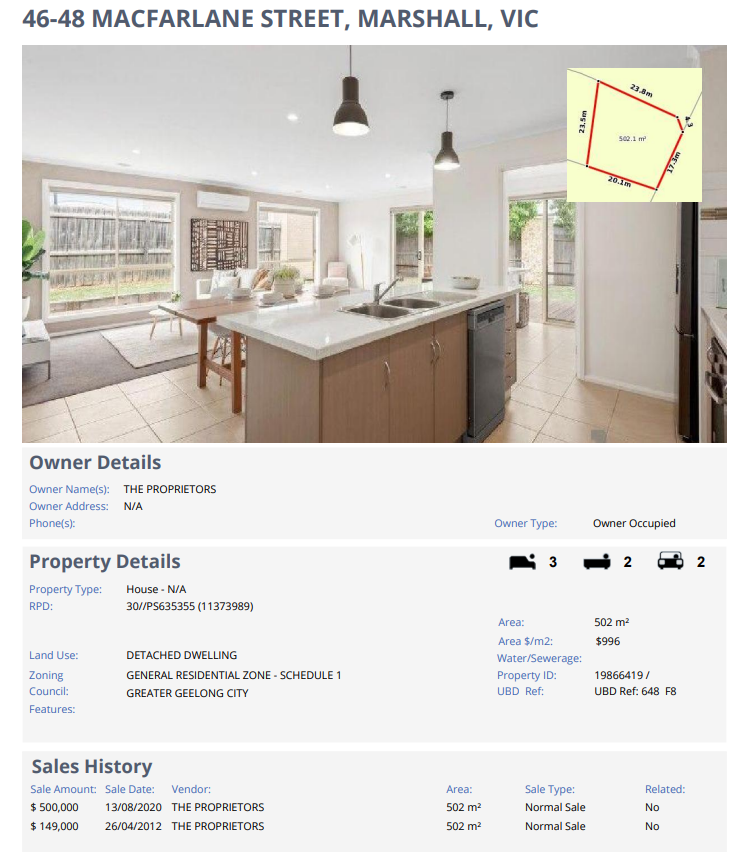

Buying? Get free property reports

Unlock unlimited property reports effortlessly. Keen on purchasing? When you use Sunbury Finance for your finance needs, we’ll provide property reports for every property of interest and promptly deliver to your inbox.

Hit the download button to view an example.

Access to over 60 lenders

FAQ

Are the services you provide free?

In most cases, yes. Mortgage Brokers are typically compensated by the lender. For specialised services like SMSF, a nominal fee may apply, contingent on various factors. Rest assured, you’ll receive transparent information upfront regarding any applicable fees tailored to your unique circumstances.

Who do you provide finance for?

We’re proud Sunbury locals, born and bred. Our roots run deep in this vibrant community – we’ve walked these streets, attended local schools, and built lasting connections with fellow residents and businesses. Our mission? To empower Sunbury individuals and enterprises alike with tailored financial solutions, whether it’s for property, vehicles, personal endeavours, or asset acquisition.

Which factors carry significance in determining interest rates?

When considering your interest rate, the Loan to Value Ratio (LVR) reigns supreme. A lower LVR typically translates to a lower interest rate, making valuation a crucial step in the process. Keep in mind, LVRs can vary across different banks depending on valuation outcomes. Additionally, factors such as loan size and your credit history play a role in determining your rate.

How will late payments or defaults impact my situation?

Lenders carefully review your credit history to gauge your credibility as a borrower. For late payments, banks typically check the past 24 months, while defaults are assessed over a 5-year period, considering whether they’re resolved or unresolved. Regardless of the scenario, these factors may categorise you as a higher risk. To navigate this, it’s advisable to connect with us for a comprehensive assessment of your situation. We’ll provide personalised guidance tailored to your circumstances.

What's the first step?

The initial step is gaining clarity on your objectives. Choose one of these three options to take action:

- Schedule an appointment using the calendar below.

- Click the ‘Get me the best deal’ button.

- Visit our ‘Contact Us’ page and fill out the form.

Following this, we’ll arrange a ‘discovery call’ to delve into your requirements. From there, you can trust us to devise the optimal approach. We’ll then present you with tailored strategies and recommendations.

I previously bought a 'house and land' package and require finance

If your property is nearing its title completion date, you’re on the brink of commencing construction. Even if you haven’t yet secured a builder or a building contract, don’t worry – we can initiate the finance process promptly. This ensures that we’re well-prepared to finalise the land settlement and seamlessly transition into selecting a builder for your new home.

How many lenders do you have on panel?

At Sunbury Finance Brokers, we are proud partners of Loan Market, Australia’s largest aggregator. Leveraging our partnership, we have access to an extensive network of over 60 lenders. Our meticulous filtering process ensures we unearth the optimal deal tailored to your needs, delivering unparalleled value.

How long does the mortgage application process take?

The duration of the mortgage application process is influenced by factors like the intricacy of your financial profile and the processing efficiency of the lender. Typically, lenders offer an estimated timeframe from submission to the commencement of application processing. Rest assured, we’ll consider this timeline when formulating our recommendations.