Mortgage Broker Sunbury | Borrowing Capacity Strategists | Get the Best Deal in Under 20 Seconds

Mortgage Broker Sunbury

Enhance cashflow, minimise interest. Tailored finance for better outcomes.

This takes you through to our Loan Market portal to get started.

Unlock the 'true' savings potential

Ready to revolutionise your mortgage game?

Introducing our Refinance Calculator—an absolute powerhouse in finding you the ultimate deal! With lightning-fast precision, it sifts through a whopping 60+ lenders to uncover the hidden gems: the lowest interest rates and the biggest savings opportunities. But here's the real kicker: it doesn't just stop at numbers. Our calculator factors in every detail, from pesky fees to the value of your precious time, delivering a crystal-clear roadmap to your financial victory. Don't just dream about savings—make it a reality with a Mortgage Broker in Sunbury

Please enter the following details to discover your potential savings.

400,000

RESULTS

66.67 %

5.99 %

$ 46,154

$ 80,000

$ 0

0.00 %

No Lenders Mortgage Insurance (LMI) payable for an LVR between 80% and 85%

Congratulations! You qualify for a better deal.

The next steps involve checking your credit score, scheduling a property valuation, and assessing your income. Please contact us right away to begin!

Fantastic! You've already secured a better deal than what the market typically offers.

Hmmmmm! Please try again. You need an LVR under 100%

$ 909,231.14

$ 862,427.17

$ 509,231.14

$ 462,427.17

$NaN

$ -400,000.00

How We Help - Mortgage Broker in Sunbury

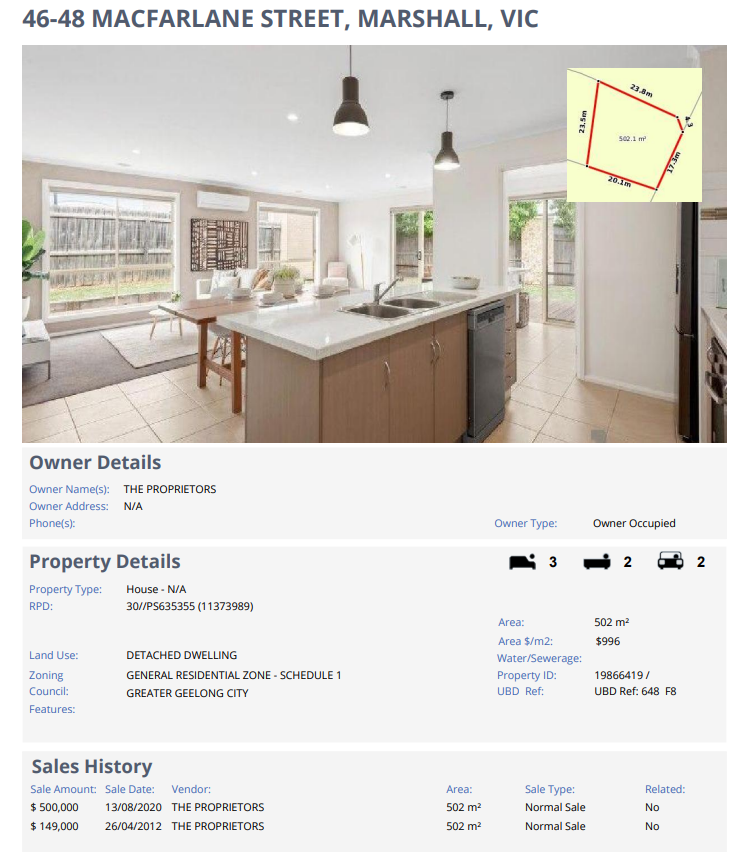

Free property reports for each property of interest, complete with estimated values to aid in your decision-making process.

Let's Purchase to Live in

Get a comprehensive assessment and deliver a strategic finance plan aimed at maximising value.

Let's Purchase an Investment

Receive a thorough assessment and strategic approach designed to optimise cash flow and deductible expenses, while simultaneously minimising interest costs.

Let's Look at Refinance Options

Obtain a comprehensive assessment of your current home loan, coupled with a precise calculation to determine whether switching lenders is the optimal course of action.

Purchasing in your SMSF

Acquire a tailored financial strategy for purchasing within a Self Managed Super Fund (SMSF) to optimise your investment approach.

Car and Asset Finance

Receive a complimentary asset or car quote customised to your unique situation, accompanied by our expert recommendation for the most cost-effective solution.

Personal Loan

Secure quick cash to address unforeseen expenses or urgent needs without delay.

Mortgage Broker in Sunbury

We enhance the role of Mortgage Brokers, offering specialised expertise in strategic mortgage planning. Our approach involves crafting comprehensive and forward-thinking strategies tailored to your financial needs. Rather than merely facilitating mortgage loans for home purchases, we prioritise leveraging mortgages as strategic instruments to optimise overall financial well-being.

Through proactive planning, we empower individuals and families to unlock the full potential of their mortgages, enabling informed decisions that extend beyond the present moment and into the future. By strategically managing mortgages and related financial matters, clients can maximise benefits, mitigate risks, and pursue their long-term financial goals with confidence.

David Cavigan is a Mortgage Broker in Sunbury and credit representative of Loan Market.

Google Reviews

Over 60 lenders in one place

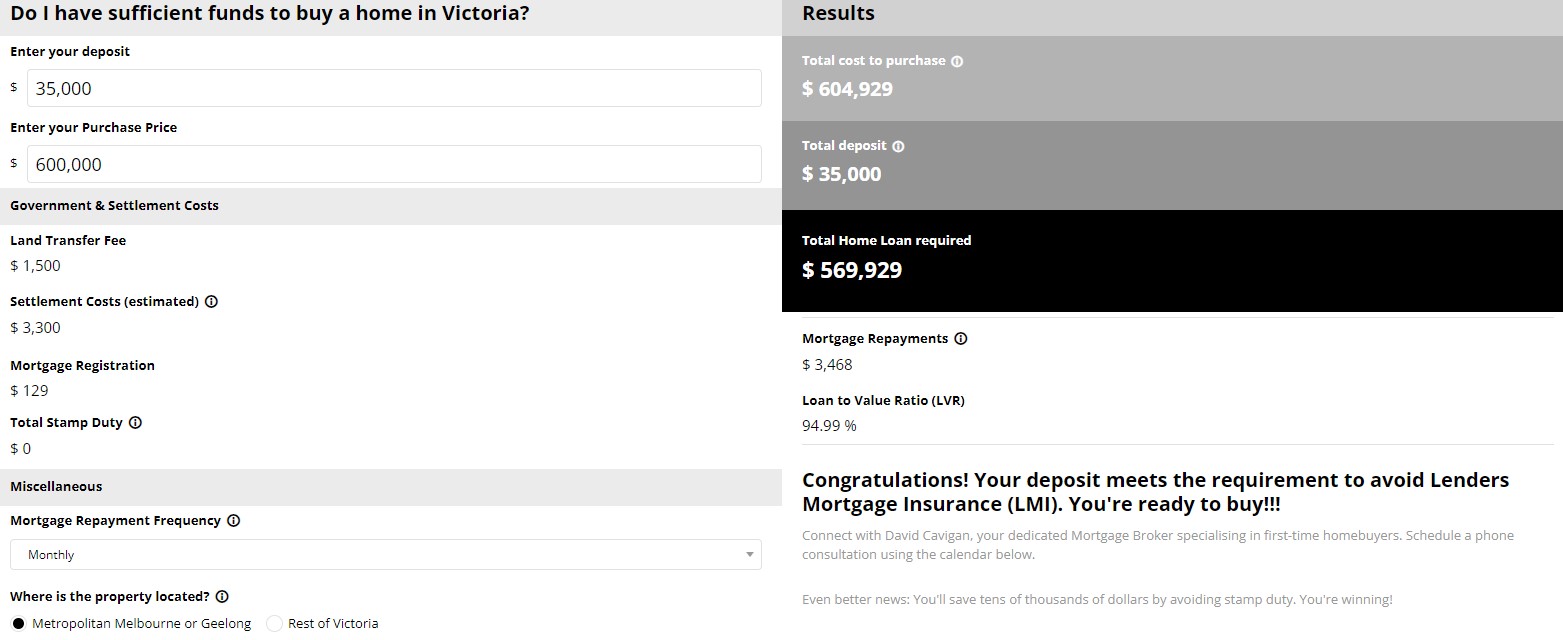

First Home Buyer?

Purchase your first home for $600,000 with just a $30,000 deposit and enjoy the added benefit of bypassing stamp duty and Lenders Mortgage Insurance. This translates to a minimum saving of $53,252.

We’ve built our very own first home buyer calculator so you can swiftly assess your readiness to buy your first home. In just seconds, you’ll discover if your deposit meets the requirements and whether you’re eligible for the Government’s First Home Guarantee scheme.

Book in a Time with David Cavigan, Mortgage Broker in Sunbury

This introductory call with David Cavigan, Mortgage Broker in Sunbury, is focused on understanding your main goals. It’s our opportunity to gain insights into your specific requirements, allowing us to craft a personalised plan that maximises benefits for you. The call will only take a few minutes to delve into what you’re seeking. We’re enthusiastic about the chance to work together and eagerly anticipate our conversation.